By Tom Coulter

Wyoming Tribune Eagle

Via- Wyoming News Exchange

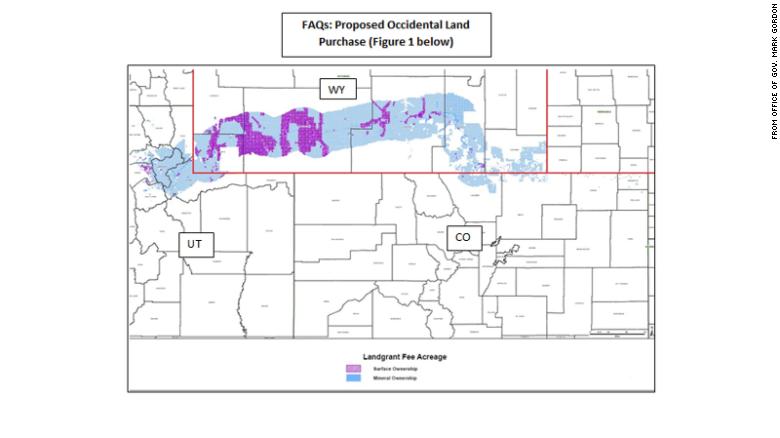

CHEYENNE – It remains to be seen whether the state will decide to buy roughly 1 million surface acres and 4 million mineral acres in southern Wyoming, but the process is now in place for the state to begin exploring such a purchase.

On the final day of this year’s budget session Thursday, lawmakers gave approval to a bill authorizing the state to explore purchasing the land from Occidental Petroleum Corporation.

Gov. Mark Gordon announced the state’s interest in the land in a news conference with legislative leadership Feb. 17. Since then, the House and Senate have worked on separate versions of bills that would allow the State Loan and Investment Board to pursue such a purchase.

After the bills advanced out of both chambers, lawmakers met in a cramped room in the Senate gallery Thursday afternoon to hash out their differences on the deal. Perhaps the biggest difference between the two chambers was on how much of the funding for such a purchase could come from the state’s Legislative Stabilization Reserve Account, commonly known as the “rainy-day fund.”

Initially, the House’s position was to not allow any of the funding to come from the rainy-day fund, but they ultimately agreed to reach a compromise that allows the state to use up to $150 million from the account, with the added requirement that any use of the account won’t negatively effect the state’s credit ratings.

Exactly how much of any potential deal would be funded through the rainy-day fund is unclear. The bill also allows the investment board to use funds from the state’s Permanent Mineral Trust Fund and its Common School Account, as well as through special revenue bonds.

In an interview Friday, Wyoming Chief Investment Officer Pat Fleming said it’s “way too early” to know exactly how the state would fund such a deal. The bill gives the state’s investment team plenty of tools in the toolbox, Fleming said, allowing them to do their due diligence and make a decision from there. Fleming also noted the stock market’s volatility could factor into the state’s decision.

While Senate File 138 allows the board to begin exploring such a purchase, there are steps along the way for both the state Legislature and the public to provide input before such a deal could actually be carried out. Before the investment board can enter into a purchase agreement, the state Legislature will have to convene to authorize the deal. Legislative leadership have said the state will have to decide on the deal in the next six months, making a special session the most likely option for lawmakers to consider the deal.

The legislation also requires the investment board to post details of the purchase on its website. Additionally, the state will be required to hold at least one meeting within each “geographic area” affected by the purchase. Laramie, Albany, Lincoln, Uinta, Carbon and Sweetwater counties are included in the acreage being considered for purchase.

In recent weeks, legislative leaders have mentioned a wealth of trona deposits in southwestern Wyoming as one of the most enticing parts of the potential deal. However, other aspects like land management, hunting opportunities and other mineral reserves are also driving the state’s interest in the deal.