•Final figures are still being calculated, but the Wyoming Public Service Commission announced plans to reduce the utility’s rate hike by nearly half.

By Dustin Bleizeffer, WyoFile.com

Rocky Mountain Power won’t get the full $140.2 million annual rate hike — a 21.6% increase — that it wants, the Wyoming Public Service Commission decided Tuesday. Instead, the utility might tap its 144,000 Wyoming ratepayers for about an extra $80 million, with the increase hitting customers’ monthly bills in January.

Alltold, sources close to the case have estimated the approved rate hike will land somewhere about 43% less than the historic increase that Rocky Mountain Power wanted.

Those are unofficial figures, based on WyoFile calculations in consultation with parties close to the rate case, and based on a handful of definitive decisions by the commission as it deliberated the rate case Tuesday.

Commission Chair Mary Throne acknowledged the unsatisfying obliqueness in the pending calculations in her closing statements.

“I want to stress for the public who may be listening that we are done with our proceedings,” Throne said, “but we don’t have a number until all of the numbers we have discussed today are run through the model and calculated.”

The commission will issue a final written order outlining details of the utility’s approved rate hike sometime in December.

Separately, the commission will consider sometime in December whether to grant Rocky Mountain Power a $50.3 million upward “fuel cost adjustment” to make up for the utility underestimating actual natural gas, coal and power market purchases in 2022. That temporary, 12-month hike was rolled into customers’ monthly bills beginning in July, but is still subject to change and final approval.

Rocky Mountain Power’s combined rate hike requests were described as “staggering” by many, including Throne.

In her opening statements, Throne repeated that it is immaterial to its Wyoming customers that even with an increase, Rocky Mountain Power may still have some of the lowest rates among utilities that serve Wyoming, and that the increase might not even allow the utility to keep pace with inflation. What customers know is “they are facing a potential large increase in one of their basic living and business expenses,” she said.

Throne, along with Commission Deputy Chairman Chris Petrie and Commissioner Mike Robinson, all agreed that a massive outpouring from thousands of Rocky Mountain Power customers opposing the “sticker shock” of the combined increases was a major factor in how they ruled on the case. However, the same statutes and laws that limit electric utility rates to only what is “just and reasonable” also bind the commission to ensure that the monopolistic utility is afforded the opportunity to earn a competitive rate of return on the services it provides in the state.

“Some elected officials suggested that we just deny the application [and] negotiate a better deal for the ratepayers,” Throne said, adding that’s not legally permissible. “In simple terms, when the evidence supports a rate increase, the commission lacks the authority to deny the application for such rate increase.”

Throne noted that the commission heard from homeowners, renters, businesses and large industries that Rocky Mountain Power’s rate increases will result in dire financial situations.

“I also have an ongoing concern about affordability,” Throne said. “We continue to enjoy low [electricity] rates in Wyoming compared to the rest of the country. But I don’t want to suggest that there are [not] pressures [because of rising rates] across the state.

“I hope all of us, collectively, and obviously not just the company in this case, can have a discussion about affordability and things we can do to address the public’s concerns about one of their basic living expenses,” she said.

What’s settled

Rocky Mountain Power claimed that its annual “base net power cost” — the total for providing electrical services in Wyoming — has risen to $354.5 million in recent years. But the commission lowered that figure to $307.1 million, based on its own analysis and analysis from five intervening parties in the case.

That $307.1 million figure is a large factor in calculating the actual amount of the allowable rate increase — but not the only one.

Commissioners also denied the utility’s request to reduce its exposure to fuel cost overruns to 0%, instead maintaining the “cost sharing band” with its Wyoming customers as a 20% to 80% split. That means if Rocky Mountain Power’s estimation for future fuel costs — mostly coal and natural gas — come in higher, the utility is responsible for 20% and its Wyoming ratepayers are responsible for 80%.

The cost-share ratio works the same way if fuel costs come in lower than estimates, resulting in a rebate for customers. Parties challenging Rocky Mountain Power mostly agreed the 20-80 cost share is an effective incentive for the utility to accurately estimate fuel costs.

The commission also reduced the company’s maximum rate of return on investments from 9.5% to 9.35%. Rocky Mountain Power requested a maximum allowable rate of return of 10.3%.

Reactions

Several intervening parties in the case, including Sierra Club’s Wyoming Chapter, vehemently opposed Rocky Mountain Power’s proposal to erase its annual fuel cost sharing band of 20% to 80%. The utility testified that coal and natural gas market prices not only accounted for more than 90% of its proposed rate increase, but those fossil fuel markets are only becoming more volatile with climate change and extreme weather conditions, according to the utility’s testimony.

Since the utility clearly sees a risk in fossil fuel markets, it should share in that risk, because it has chosen to rely on those fuels, critics said.

“We think the Commission did the right thing by maintaining the 80-20 sharing band,” Sierra Club Wyoming Chapter Acting Director Rob Joyce told WyoFile. “And they also significantly reduced [Rocky Mountain Power’s] proposed fuel costs, which will lessen the rate impact for customers.

“But,” Joyce added, “as we’ve seen in this case, volatile fossil fuels will continue to put pressure on customers’ bills until we transition to clean energy, which was already shown in this case to reduce costs by tens of millions of dollars.”

The Wyoming Industrial Energy Consumers group, which represents trona, oil and natural gas producers and refiners, was also pleased with the commission’s decision to maintain the utility’s fuel cost sharing risk.

“The Public Service Commission’s decisions to lower Rocky Mountain Power’s authorized return on equity down to 9.35%, and rejection of Rocky Mountain Power’s request to eliminate the power cost sharing band mechanism, will help keep costs down for all ratepayers,” WIEC’s Holland and Hart attorney Abby Briggerman said.

The Wyoming Office of Consumer Advocate noted that the commission followed several of its recommendations to reduce the utility’s proposed rate hike.

“Overall, we’re generally pleased with the totality of the decision,” agency Administrator Anthony Ornelas told WyoFile.

Wyoming lawmakers responded to the rate hike with a raft of proposed legislation — first with a proposed moratorium on wind energy development in Wyoming. But that proposal was eventually abandoned, in part, because Rocky Mountain Power’s own industrial customers in the state said it would only further increase electricity costs. They noted that, according to the utility’s testimony, the addition of wind, solar and other renewable energy resources have reduced its costs in Wyoming by about $85 million.

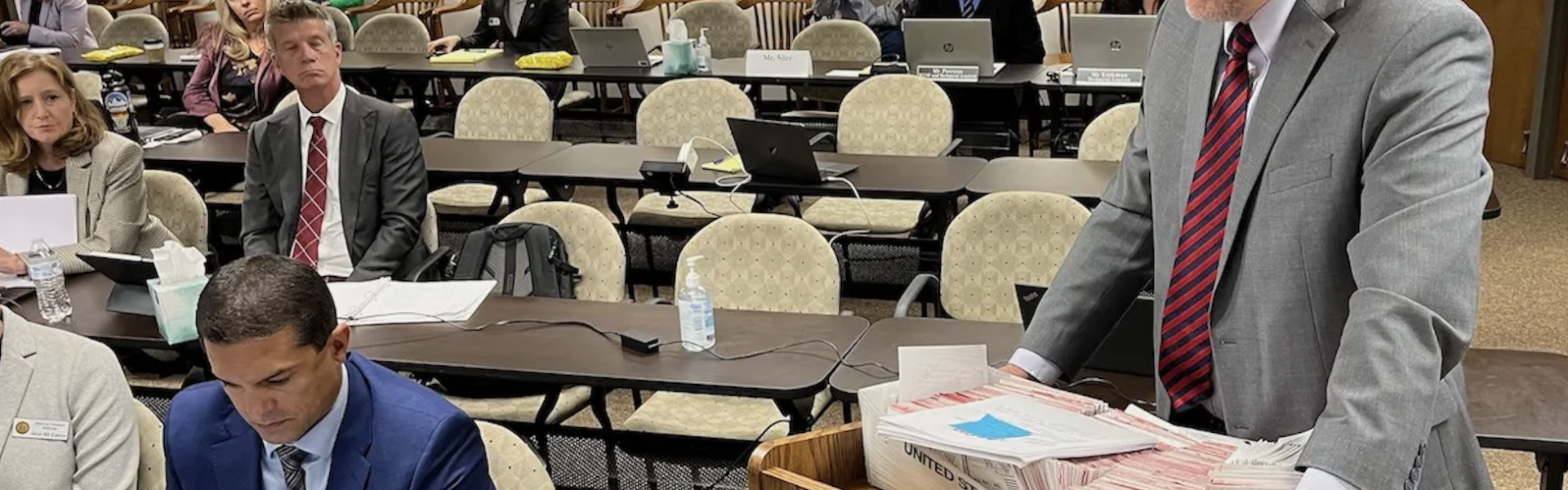

The Corporations, Elections and Political Subdivision Committee is set to introduce six draft bills that aim to curb rising utility costs when the legislature convenes in February.

WyoFile is an independent nonprofit news organization focused on Wyoming people, places and policy.