Lincoln County Treasurer Jerry Greenfield had a warning for those charged with overseeing the money coming from property taxes and then used to support various districts. He emphasized care needs to be used in expending those funds.

Greenfield was the guest speaker the Star Valley Chamber of Commerce Luncheon in Thayne Feb. 5.

“I collect the money but the money goes to all of the special districts, but primarily education,” he explained in a subsequent interview with SVI.

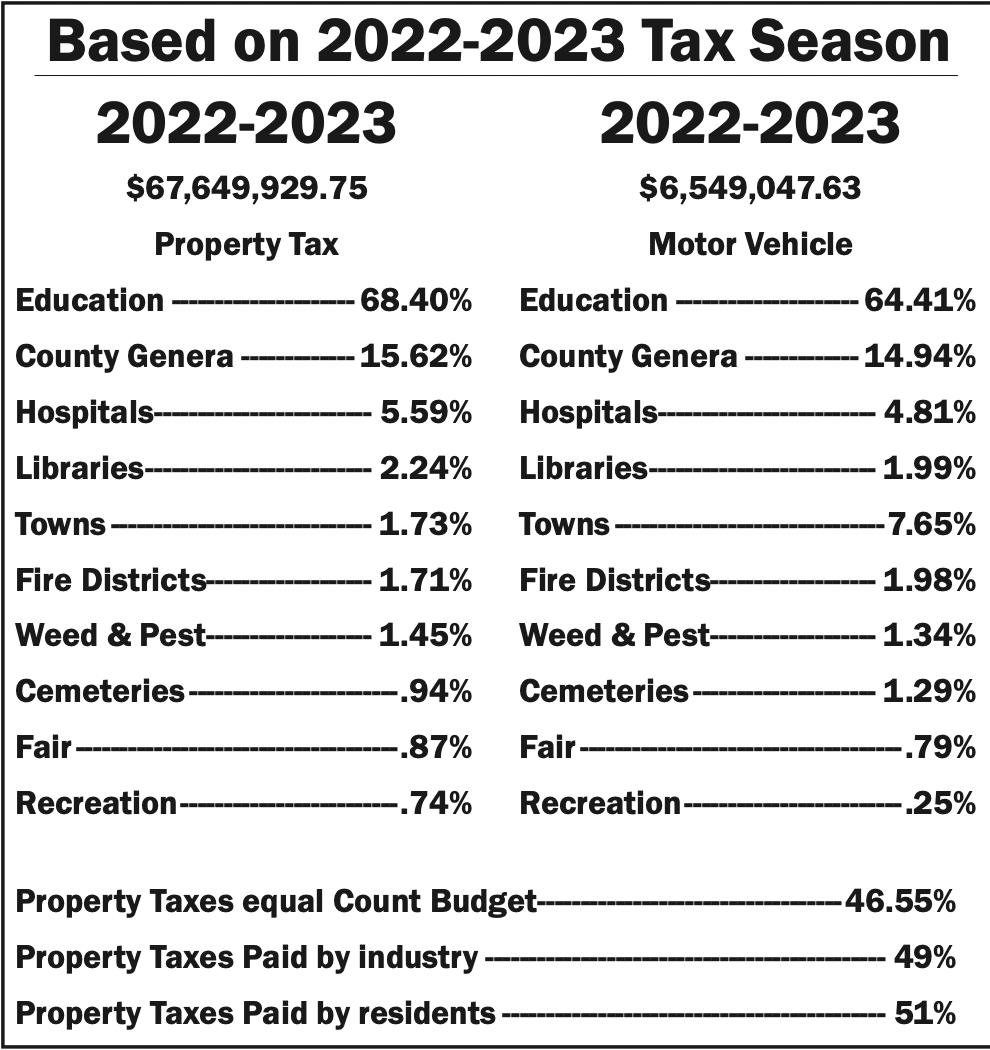

A treasurer department’s chart shows 68.40 percent of the property taxes in Lincoln County went to Education based on the 2022-2023 tax season.

The remainder of the funds were distributed to special districts related to health care and emergency services. Please see the entire chart on page 12A.

The treasurer also offered a waring about a proposal to cut taxes by 50 percent now circulating through Wyoming. He suggested the proposal would probably lead to a state income tax to find the remaining funds needed sustain public services.

“I’m concerned about the 50 percent cut in property taxes, that would be a direction to a state income tax,” he counseled.

“The money has to come from somewhere.”

The treasurer said Wyoming is often compared to “Idaho where property taxes are cheaper.”

He continued, “But when you compare it with [Idaho’s] state income tax and you add the two together there is not much difference having both a property tax and an income tax.”

He concluded with the advise for those overseeing the district budgets. “As board members on special districts please watch how we spend our money because we are letting things get out of control.”