By Mike Koshmrl, WyoFile.com

SHOSHONI—Up until the last few years, many residents of this town of 600 people near the east bank of Boysen Reservoir believed their community was dying out.

The median age was 55. Businesses had little interest in coming to town. Chris Konija, the town’s chief of police, said there was “almost an acceptance of fate” that Shoshoni was on the path to becoming “another Jeffrey City” — a former uranium mining boomtown now home to just a couple dozen people.

“It was known as a living ghost town,” Konija said of his community. “It was a town that was slowly decaying and had been for years.”

Due to a confluence of factors, however, Shoshoni has started to come back from the brink.

As the housing market boomed in places like Lander and Riverton, it pushed more residents to look for housing in Shoshoni. The COVID-19 pandemic — and the premium it put on living amid open spaces — was also “partly” responsible for the change of fates, he said.

The town’s mayor, Joel Highsmith, was the “driving force” in helping revive Shoshoni, Konija said. Now, a new plaza has reinvigorated the downtown area. The municipality hosted events, like a car show and concerts, in the summer of 2022. Businesses are courting Shoshoni and existing ones want to expand.

But that’s been a challenge, Konija said. There’s nowhere for their prospective employees to live. One local developer recently located nine prefabricated homes in Shoshoni, he said, and already every one is rented out. The housing shortage, he said, has slowed a planned expansion at the town’s commercial mushroom farm and stymied the effort to attract a hotel.

“If you don’t have housing and places to live, you can’t have businesses that thrive,” the police chief said. “They are codependent.”

Shoshoni’s housing shortage isn’t unique. There are major issues with affordability and lack of supply nationally, and the West has generally been pinched harder than most regions. Wyoming’s affordable housing dearth in super-pricey destinations like Jackson is well-known, but the state has been hit across the board.

“It’s been super eye-opening to us that all of our communities are having housing issues,” Wyoming Association of Municipalities Executive Director J. David Fraser said. “When Shoshoni’s telling you that they’re having housing issues, you know it’s a statewide issue.”

Fraser made those remarks while testifying before the Wyoming Legislature’s Joint Corporations, Elections and Political Subdivisions Committee in June. Surveys the association conducted indicate Wyoming communities of all shapes and sizes have a paucity of dwellings for their residents, he said.

“We were hearing it from everybody,” Fraser said. “Large towns, small towns, college towns, tourist towns, rural towns.”

Fraser ran through the results of a survey that, at the time, had been completed by 41 municipalities, from La Barge to Lander to Lingle. Of those towns and cities, 88% reported needing more affordable housing, while 83% sought more workforce housing. Some 70% of respondents indicated lacking housing was hurting their efforts to attract and grow businesses.

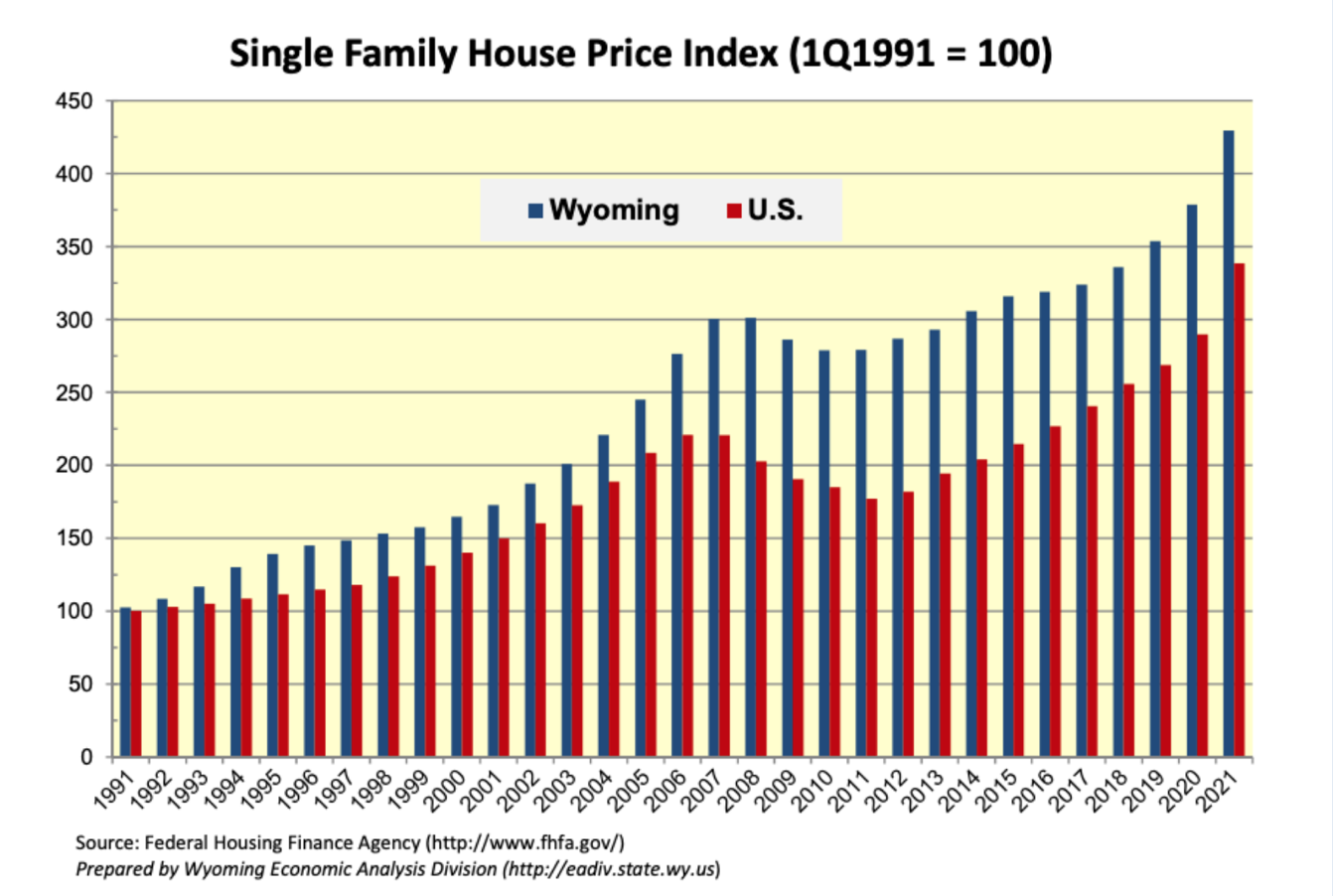

The Corporations committee heard those remarks in preparation to draft bills during the interim session related to its No. 2 priority: exploring solutions to a workforce housing crisis in a state where the average single-family home price has surpassed $425,000.

One of those bills would have created a state housing trust fund, something 47 of 50 states currently possess. The simple act of creating the fund concept — not necessarily appropriating funds to fill it — proved a non-starter, however. Anna Johnson, a staff attorney for the Legislative Service Office, told the Corporations committee at a Casper meeting two months later it was “problematic” to create a government-administered trust fund that would pick private businesses or nonprofit organizations to be the recipients of state appropriations.

“There’s a constitutional prohibition against legislative appropriations for charitable or industrial purposes,” Johnson said, “unless the recipient is under the control of the state.”

Rep. Dan Zwonitzer (R-Cheyenne), who co-chairs the committee, watched the idea die.

“The committee voted not to sponsor a bill on a statewide housing trust fund by one vote,” he told WyoFile. “But I believe you will see several legislators, probably me included, bringing it back as an individual bill.”

Another idea that still has potential as a Corporations-sponsored bill is the concept of land banking. That would allow municipalities and other public entities to acquire and possess vacant and abandoned properties for housing.

It’s not yet clear if there’s momentum in the direction of a workforce housing solution elsewhere in the Legislature. A Revenue Committee-sponsored county-

Such a business could benefit a community like Shoshoni in particular. Local builders don’t have the capacity to produce the volume of homes the local economy demands right now, Konija said.

“They can do approximately two houses a year,” he said of the town’s most active builder.

Just west of town, Shoshoni’s municipal government has the deed on a platted 40-acre parcel of land where the vision is for 72 homes on third-acre lots. Getting that area built out is “easily attainable,” Konija said, but developers aren’t keen on building in rural areas unless they’re incentivized to do so. Left to the free market, he said, Shoshoni is competing for builders with places like Casper and Cheyenne, which are also in need of housing.

“And then basically nothing happens,” Konija said, adding that a mechanism like a statewide housing trust fund or another incentive program could help.

Another factor that could ease the tight market is federal government intervention. In its battle to rein in inflation, the Federal Reserve raised benchmark interest rates by another 0.75% last week. Mortgage rates have about doubled to an average of over 6%, effectively increasing the cost of homeownership. So far, however, the rate hikes are not having much effect on demand for homes attainable for the typical Wyoming working family — less than $300,000, for example.

“If you have a house in that price range [on the market] in any community in Wyoming, it’s going to be sold in days,” said Laurie Urbigkit, lobbyist for the Wyoming Housing Alliance and Wyoming Realtors. “Anything under $200,000 is snapped up in a heartbeat, almost anywhere.”

For the middle class, she said, there’s still an “extreme shortage.”

Urbigkit declined to comment on the concepts of a statewide housing trust fund or land banking, saying she’d first want to see draft bills.

“A lot of this is a local issue, and solutions may be at the city and county levels,” Urbigkit said. “There’s a limited amount the state could do to … reduce the cost of workforce housing.”

The Legislature’s Corporations committee will consider a draft bill workup for the Wyoming land bank act during its next meeting Oct. 13-14 in Cheyenne.