By Noah Zahn

Wyoming Tribune Eagle

Via- Wyoming News Exchange

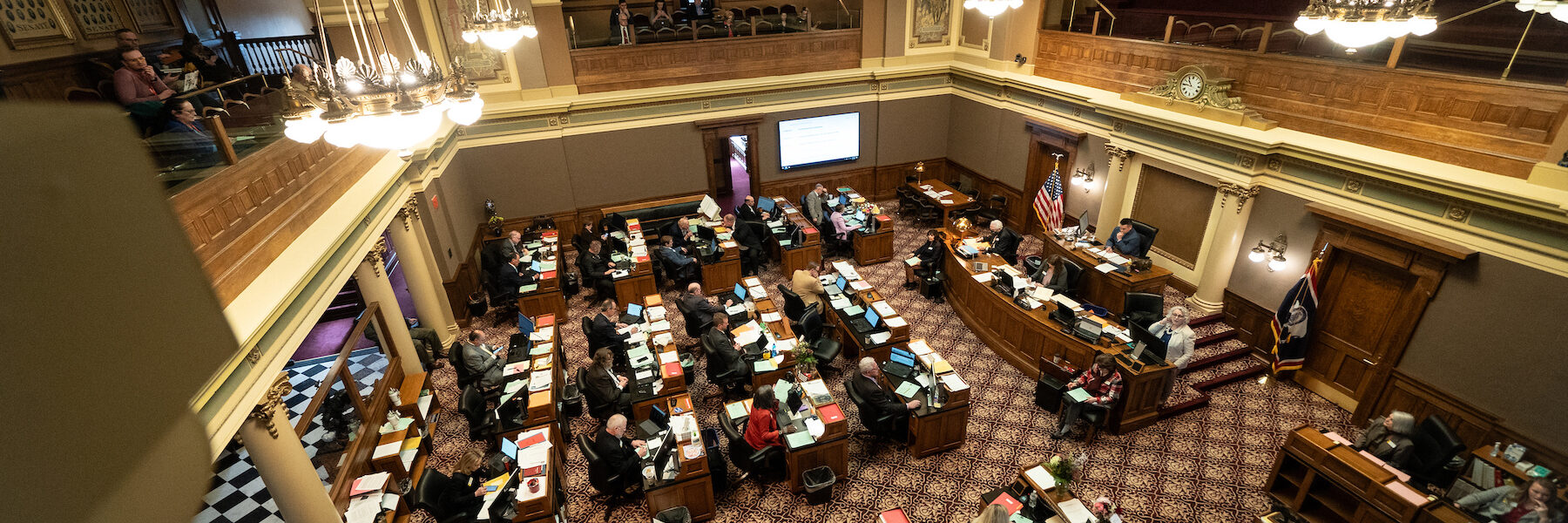

CHEYENNE — As 2026 is now in full swing, the state of Wyoming is preparing to implement a slate of legislative changes that will impact areas from health care to property taxes.

The following is an overview of the key laws and regulations that went into effect Thursday, following the passage of new laws over the 2024 and 2025 legislative sessions.

‘Gold carding’ in health care

The second section of House Bill 14, which was approved in the 2024 legislative session, is now law. It introduces a concept known as “gold carding.” This law is designed to streamline the prior-authorization process for health care providers who have a proven track record of medical necessity.

Beginning this year, health care providers will be granted a one-year exemption from prior-authorization requirements for a specific health care service, excluding pharmacy and prescription drugs, if they meet certain criteria.

To qualify, a provider must have submitted at least five prior-authorization requests for that service in the previous year and had at least 90% of those requests approved by the insurer.

Once granted, this exemption remains in effect for 12 months, though insurers may perform retroactive reviews of claims to ensure the 90% threshold continues to be met.

If an insurer decides to revoke an exemption, it must provide the provider with a plain-language explanation and an opportunity to appeal the decision.

Continued property tax exemptions

The business community will see substantial tax relief this year through two major pieces of legislation aimed at reducing property taxes.

Senate File 48, passed in 2025, creates a new business property tax exemption.

Under this act, the first $75,000 in fair market value of business property owned by a person in each county is exempt from taxation, up from the previous $2,400. For the purposes of this law, “business property” refers to taxable personal property but excludes property already exempt for personal or family use.

This measure is expected to decrease total property tax revenues by approximately $6.7 million per year for the state starting in fiscal year 2027, according to the bill’s fiscal note.

Complementing this relief is SF 49, which changes the way tangible personal property is valued and depreciated for tax purposes.

The law establishes a “depreciation floor” set at 20% of the reported installed cost of the property. Once the property reaches this 20% floor, its trending factor remains constant until it is removed from service.

This cap ensures that businesses do not continue to pay taxes on property that has largely lost its market value, leading to an estimated $33.6 million reduction in total property taxes annually for FY 2027 and FY 2028.

Tax on carbon capture

SF 61 amends the Wyoming Environmental Quality Act to refine the pollution control property tax exemption.

The new law specifies that facilities constructed for the sole purpose of capturing nonpoint source carbon dioxide do not qualify for the ad valorem property tax exemption.

Historically, exemptions have applied to property used primarily for the prevention or control of air, water or land pollution. This revision makes it so that carbon dioxide capture facilities are excluded from that specific benefit unless they meet other statutory requirements.

License and ID requirements

HB 30 brings several revisions to driver’s licenses and state IDs. Notably, it changes the expiration rules for drivers under the age of 21.

Instead of expiring on the licensee’s 21st birthday, these licenses will now expire five years after issuance, bringing them in line with standard adult licenses. The act also lowers the fee for a replacement license to $20, down from $30, to encourage residents to update lost or destroyed cards rather than waiting for a full renewal.

Additionally, all state identification cards that are not driver’s licenses will now be required to read “FOR IDENTIFICATION PURPOSES ONLY.”

SF 33 introduces a new marking for noncitizen identification. Any driver’s license or ID card issued to a person who is not a U.S. citizen but has lawful alien status must now explicitly state “Not U.S. citizen” on the card.

Two new Wyoming license plates

For those looking to customize their vehicles, the Wyoming Department of Transportation has started to make search-and-rescue account license plates and rodeo license plates available to the public.

The rodeo plate has a $30 specialty fee, and drivers can opt to donate an additional $20 or more to support rodeo programs at the University of Wyoming and community colleges throughout the state.

WYDOT is distributing only 2,300 pairs of rodeo plates, with 100 sets allocated to each county. The initial distribution to counties was selected randomly.

The search and rescue plate costs $150 for the SAR fund, plus a $30 WYDOT specialty fee.

Both plates are approved for non-commercial motor vehicles, meaning motorcycle and off-road vehicle sized plates will be available for each design.

Anthrax outbreak protocols

HB 90 requires the Wyoming Livestock Board to establish a standard notification protocol for anthrax outbreaks following an outbreak in parts of the state that occurred for the first time since the 1970s.

This protocol is designed to quickly inform livestock producers, veterinarians, brand inspectors and relevant agencies when a positive anthrax test is recorded. By formalizing this communication, the state aims to mitigate the spread of the disease and protect both animal health and those in the ranching community.

The above story may be used ONLY by members of the Wyoming News Exchange or with the express consent of the newspaper of its origin.