• Despite assurances from Bill Gates-backed TerraPower, some skeptics contend its Wyoming project could be a “financial disaster.”

By Dustin Bleizeffer, WyoFile.com

Factors that led to the recent demise of a “small modular reactor” energy project in Utah do not directly apply to TerraPower’s nuclear energy project in Wyoming, the company says.

Timing delays, forecasted cost overruns and a growing lack of faith in the effort foiled the NuScale Power Corporation’s plans. In contrast to the Utah project’s inferior design — “just an adaptation of the same technology that has been running nuclear power plants in the United States for the past, you know, five, six decades” — and the Utah Associated Municipal Power Systems’s failed commercialization plan, TerraPower’s Natrium project in Kemmerer has a solid design and the company is on track to deliver on its promises, Jeff Navin, the company’s director of external affairs, said.

“We have a lot of high confidence in our ability to succeed,” Navin told WyoFile. “We believe in our technology. We have strong support from the federal government, and we have a set of investors who are totally committed — not just to getting this project completed. But to ensure that TerraPower and Natrium become commercially viable technologies.”

Not everyone, however, is convinced that NuScale’s demise in Utah isn’t a sign of trouble for TerraPower’s ambitions in Wyoming.

Both NuScale and TerraPower tout their nuclear energy technologies as “advanced” and “next generation,” and both companies claim that market conditions are ripe for commercial deployment. But it’s all been tried in the past, and with disappointing results, according to David Schlissel, director of resource planning analysis for the Institute for Energy Economics and Financial Analysis.

Schlissel authored an analysis of the NuScale project in February 2022 predicting its demise. He expects the same fate for TerraPower’s Natrium project in Wyoming.

“There’s every reason in the world to believe that [the Natrium project in Wyoming] is going to be a bigger financial disaster,” Schlissel told WyoFile.

Down and out in Utah

NuScale and Utah Associated Municipal Power Systems canceled their joint Carbon Free Power Project this month. “It appears unlikely that the project will have enough subscription to continue toward deployment,” according to a UAMPS statement.

In other words, the project didn’t attract enough commitments among utilities to take the 462 megawatts of nuclear power, along with the associated costs that would be passed on to ratepayers. After estimated costs for the project nearly doubled from about $5.3 billion to $9.3 billion, those who had flirted with signing contracts for the power began dropping out, according to reports.

The plan was to use NuScale’s “simplified” light-water reactor design to build a six-modular nuclear power plant at the U.S. Department of Energy’s Idaho National Laboratory campus. Developers envisioned a carbon emissions-free, 24/7/365-available power source to replace generation lost to retiring coal-fueled power plants. They also hoped to eventually add more capacity and connect the plant to other service territories, including PacifiCorp’s transmission system that serves Wyoming and five other western states.

NuScale’s technology even won a “design approval” by the U.S. Nuclear Regulatory Commission — the first such approval for a small modular reactor plant.

But as project developers refined construction costs, the numbers kept creeping upward, falling in line with the nuclear power industry’s long history of over-promising and under-delivering, according to IEFFA’s Schlissel.

“It’s too uncertain, too expensive, too risky and too late,” he said. “Those same conclusions go for the Natrium reactor.”

Small, modular strategy

Both NuScale and TerraPower make a similar pitch that fits nicely with carbon emissions-free energy priorities that have been shared among recent Republican and Democratic administrations: deploy nuclear energy to help fill in the intermittent electrical availability gaps created by wind and solar additions to the grid.

They also agree that smaller is better.

Acknowledging the industry’s long history of construction cost overruns, the idea is to build reactors small enough that they can be manufactured in a single facility and transported to a power plant location. This way, costs are more controlled and technical bugs can be worked out. Then add more “modular” reactors as needed, driving manufacturing costs down as the process is streamlined.

The U.S. Department of Energy is backing the “small modular reactor” strategy with billions of dollars in support, noting advantages such as “relatively small physical footprints, reduced capital investment, ability to be sited in locations not possible for larger nuclear plants and provisions for incremental power additions.”

Despite the NuScale/UAMPS project cancellation, the federal agency still believes that small modular nuclear reactors will be successfully integrated into the U.S. power grid.

“We have high confidence in the advanced nuclear options that will be deployed later this decade to help meet clean energy needs and 24/7-reliability,” Department of Energy Idaho National Laboratory’s Director for Nuclear Science and Technology Jess Gehin told WyoFile. “The nation is going to need this as we transition our energy system.”

Natrium ‘demonstration’

Here are the basics of TerraPower’s Natrium “demonstration” nuclear plant at Kemmerer.

° The single-reactor nuclear facility will have a steady generating capacity of 345 megawatts with an energy storage feature that allows it to ramp up to 500 megawatts for short periods.

° Rather than NuScale’s “light-water” design for cooling, which has been the industry standard, Natrium will rely on liquid sodium, which TerraPower claims is safer, easier to manage and consumes much less water.

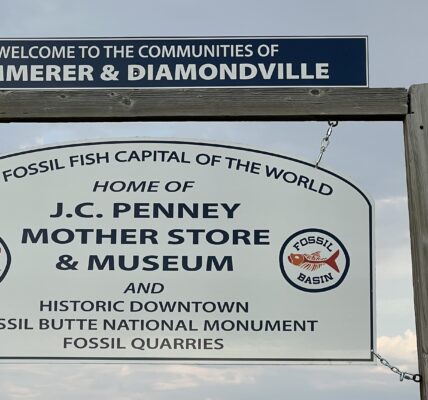

° It will be “co-located” next to PacifiCorp’s Naughton coal-fired power plant just outside Kemmerer, taking advantage of existing industrial infrastructure, including access to PacifiCorp’s electrical transmission system that serves Wyoming and five other western states.

° PacifiCorp, which operates as Rocky Mountain Power in Wyoming, has tentatively agreed to take on ownership of the power plant sometime after it goes into operation in 2030. The utility is also considering taking on five more Natrium reactors, co-locating them with coal-fired power plants that it wants to retire in Wyoming and Utah.

° TerraPower — backed by Microsoft billionaire Bill Gates — has a 50-50 construction cost share agreement with the Department of Energy, with an estimated price tag of $4 billion. The company received an initial installment of $80 million in 2020.

° TerraPower plans to file its licensing application with the Nuclear Regulatory Commission in March, kicking off what it hopes is an expedited review process.

Cost structure

In addition to its superior design, TerraPower’s Navin said, the company has a particular advantage compared to the failed NuScale/UAMPS project: It is negotiating with a single, multi-state utility to take on 100% of the power rather than multiple small municipal utilities.

“The way their deal was structured, they had to have many, many different small communities sign off on the deal, and that made it really challenging,” Navin said of the NuScale/UAMPS project.

While PacifiCorp stated in April it “expects to finalize commercial agreements for the Natrium project” by the end of this year, that timeline has been delayed.

“Progress is being made in developing commercial agreements between PacifiCorp and TerraPower,” PacifiCorp spokesman Dave Eskelsen told WyoFile via email. “But PacifiCorp does not anticipate finalizing such agreements prior to the end of 2023.

“PacifiCorp is staying informed of progress,” Eskelsen added, “and continues to update our analysis of the future completed project in our Integrated Resource Plan to determine if the resource is in the best interests of customers.”

PacifiCorp’s wait-and-see approach is good news for its Rocky Mountain Power customers in Wyoming, said Shannon Anderson, attorney for the Sheridan-based landowner advocacy group Powder River Basin Resource Council.

“There’s still a lot of risk with this facility,” Anderson said, “and you don’t want ratepayers to be on the hook for that. You want TerraPower to be on the hook.”

Whether the Natrium power plant will help stabilize costs for ratepayers or add to rising utility costs is uncertain, Anderson said. The company hasn’t yet offered detailed information on actual construction costs or what it will cost to operate the facility.

Many of those details will become available as construction begins and TerraPower works out an agreement with PacifiCorp, Navin said.

“We do anticipate that we’re going to have to make some adjustments to the [construction] budget,” mostly due to inflation, labor costs and interest rates on loans, Navin said. “We are still anticipating that we’re going to be pretty cost-competitive, and that the operations piece is going to be a relatively minor portion.”

The U.S. Department of Energy’s 50-50 construction cost support — which is currently estimated at $2 billion — is a grant and won’t fall on either TerraPower or ratepayers to pay back, Navin said. However, it’s doled out in pieces and relies on Congress to include the appropriations in its annual budget approvals.

If the project should fail before it goes into operation, Wyoming taxpayers won’t be on the hook for any costs, Navin said.

“We would have a responsibility to clean up the site and move on,” he said. “But we would not be sending a bill either to [PacifiCorp/Rocky Mountain Power] or to the state of Wyoming.”

Fuel delay

The Natrium project in Kemmerer has already experienced a major setback.

Unlike NuScale, which requires readily available low-enriched uranium fuel, the Natrium design requires high-assay, low-enriched uranium (HALEU) fuel. TerraPower had to cut ties with the Russian state-owned Tenex — the only facility in the world with the capacity to supply commercial volumes of HALEU — after Russia invaded Ukraine.

That pushed the anticipated startup date of 2028 to 2030.

Now, TerraPower is relying on a federal effort to “downblend” weapons-grade uranium as the Department of Energy works with private partners to stand up a U.S.-based supply of HALEU.

The Biden administration in October included in a list of “critical domestic needs” sent to Congress a $2.2 billion appropriation to support a domestic HALEU supply while also calling for a long-term ban on HALEU from Russia. Centrus Energy Corp began uranium enrichment operations in October at the American Centrifuge Plant in Ohio to begin producing HALEU, albeit at a “modest” volume.

“We are cutting it close in terms of our ability to meet the 2030 timeframe” regarding initial fuel deliveries, Navin said. “We’re going to take everything we can and sort of put it together and hopefully get that added up to be able to get our first core load to keep us on schedule.”

The project’s multiple “unknowns” — fuel supply, ultimate construction and operational costs and commercial structure — add up to a familiar sounding drumbeat that typically results in a doomed nuclear energy project, Schlissel said.

“It’s just expensive to build technologies that are very complicated and that need to be safe,” he said. “There’s no reason to believe that Bill Gates has a magic touch and that his company has discovered something that lots of intelligent people have missed in the past.”

There is a rush to take advantage of federal support and renewed interest in nuclear power generation, Navin acknowledged. And some projects will fail while others succeed.

“We are committed to getting this project done,” he said. “We’ve invested a decade-and-a-half of time as a company, millions and millions of [dollars], hundreds of thousands of man-hours to get to this point. There are going to be bumps in the road for the industry, but we feel like we’re really well positioned to weather that storm.”

WyoFile is an independent nonprofit news organization focused on Wyoming people, places and policy.