• The stimulus is intended to ‘equalize’ a federal tax incentive that rewards permanent CO2 storage over carbon dioxide used to produce oil.

By Dustin Bleizeffer, WyoFile.com

A measure that would provide a $10 million “stimulus” to encourage more carbon capture for use in the oil industry will advance to the upcoming legislative session following a special hearing this week by the Joint Minerals, Business and Economic Development Committee. The stimulus, according to committee members, aims to enhance a federal tax credit program that they say favors direct storage of the greenhouse gas over pumping it into oilfields to produce hard-to-get reserves.

“The intent of this bill is simply to level that playing field so that that [oil] producer is in the same position financially as [an operator of] a permanent sequestration facility,” Sen. Chris Rothfuss (D-Laramie) said.

Wyoming has courted and coerced companies to collect carbon dioxide — via direct air capture and at industrial smokestacks, for example — and it has created a legal and regulatory framework to inject the planet-warming gas into deep saline formations for permanent storage.

But there’s also growing demand for carbon dioxide in the oil industry, a key economic driver in the state.

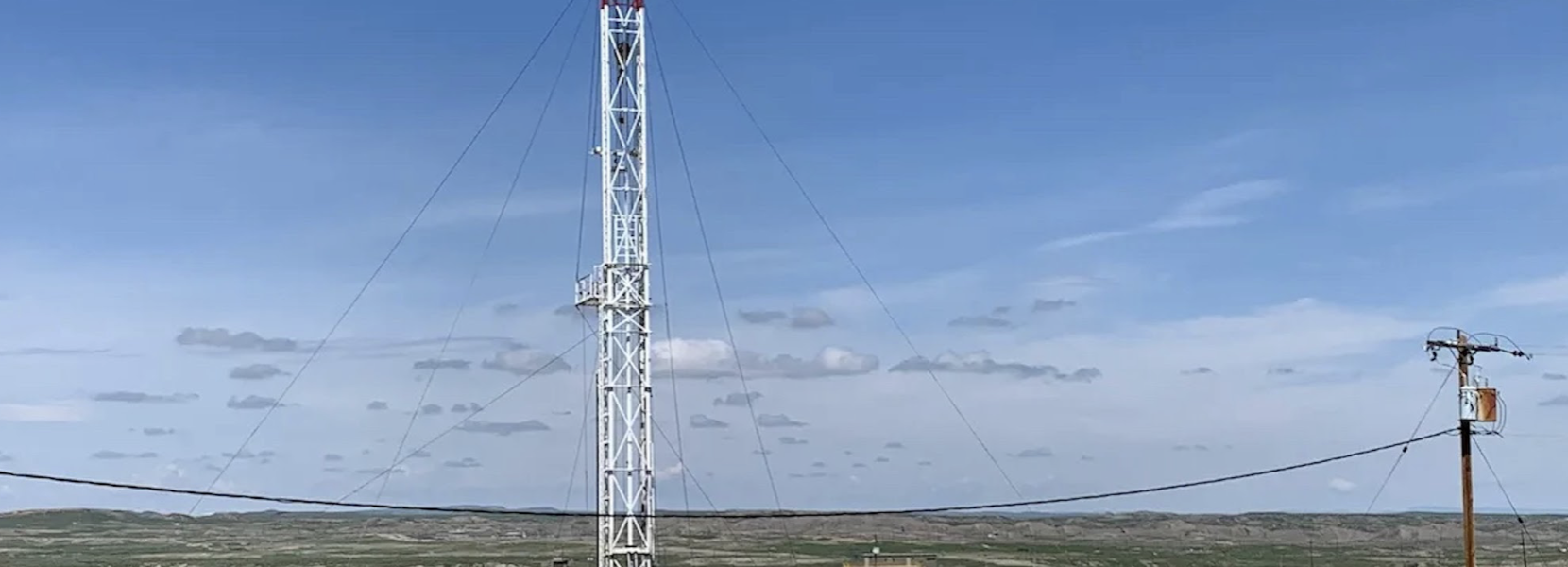

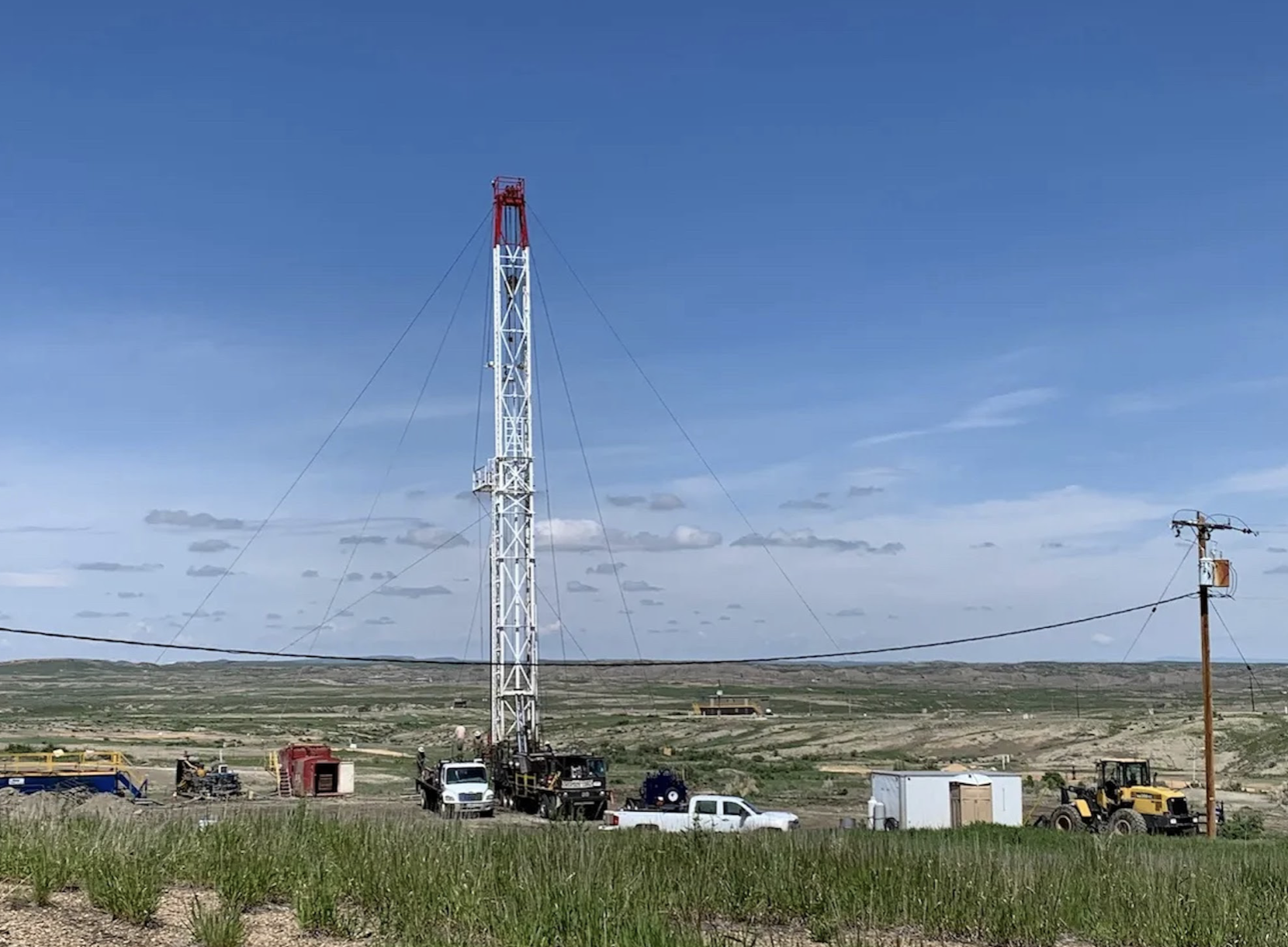

Carbon dioxide is commonly injected into oilfields to “sweep” oil that’s left behind after primary production methods such as pumpjacks can no longer recover commercial volumes of oil — a practice that’s been in play in Wyoming for some 37 years, according to the Wyoming Enhanced Oil Recovery Institute. But the industry worries there won’t be enough carbon dioxide available to meet growing demand.

The recently expanded federal 45Q tax credit program encourages both direct carbon dioxide storage and its use in “enhanced oil recovery,” or EOR. But because of climate considerations, the program offers a bigger financial incentive for simply “sequestering” carbon dioxide. The federal program offers $85 per metric ton for simple sequestration compared to $60 per metric ton for EOR.

The Minerals Committee wants to help close that federal incentive gap with the draft Carbon dioxide-enhanced oil recovery stimulus measure. The bill would create a $10 million fund administered by the Wyoming Energy Authority, which would offer an extra $10 per metric ton to those 45Q-qualifying parties that capture carbon dioxide for use in tertiary oil production.

“For the oil industry, CO2 has always been seen as a very valuable commodity,” Enhanced Oil Recovery Institute Director Lon Whitman said. Though the state is encouraging direct carbon dioxide storage, Whitman added, it stands to earn more revenue if the gas is used to produce more oil, which provides hundreds of millions of dollars in severance, royalty and property taxes.

“The problem is that there’s an incentive for dedicated storage over enhanced oil recovery,” he said.

Potential dividends

The bill will be introduced in the Senate in the budget session that begins Feb. 12. It includes a $10 million appropriation from the Legislative Stabilization Reserve Account, which would be backfilled by diverting half the revenue earned from Wyoming’s 6% severance tax on produced oil.

Proponents of the bill, which include the Enhanced Oil Recovery Institute and the Petroleum Association of Wyoming, say that $10 million investment stands to earn a handsome return to the state’s coffers — to the tune of hundreds of millions of dollars over eight years, according to a report authored by University of Wyoming energy economics professor Timothy Considine.

“At a minimum, for every dollar spent on incentives, net severance and ad valorem taxes increase by $2.40,” the report concludes.

Who benefits?

Committee members stressed that the $10 per metric ton “stimulus” be offered only to the party that captures carbon dioxide — not the party that injects the gas into oilfields. So far, there are only two companies that capture carbon dioxide in Wyoming: ExxonMobil at its Shute Creek natural gas processing plant near LaBarge, and Contango Oil & Gas’ Lost Cabin natural gas processing plant east of Shoshoni.

Rep. Scott Heiner (R-Green River) worried that the primary beneficiary of the stimulus might be a couple of massive corporations. But Petroleum Association of Wyoming President Pete Obermueller said his members support the measure no matter who earns the benefit.

“It really doesn’t matter where the carbon comes from, because Wyoming will benefit regardless,” Obermueller said.

The Sheridan-based landowner advocacy group Powder River Basin Resource Council has opposed several past legislative efforts to offer the oil and gas industry tax breaks and incentives. The group has also changed its tune on EOR, which it used to generally support.

The council in December amended its 2011 resolution in support of the practice to now oppose it, stating in part, “the technology is more likely to contribute to a greater atmospheric load of greenhouse gasses rather than reducing anthropogenic emissions.”

“There’s a reason why the [Inflation Reduction Act] has a higher incentive for permanent storage,” council attorney Shannon Anderson said. “And, of course, climate is not mentioned once” in the stimulus measure.

Whitman of the Enhanced Oil Recovery Institute contends that oil produced by pumping and storing carbon dioxide could actually be carbon negative. Regardless, there’s no financial downside to the stimulus and a high probability of revenue returns.

“What this bill says is ‘We are open for business,’” Whitman said. “We’re trying to find ways to help the industry survive and grow with the constraints and the controls that are developing.”

WyoFile is an independent nonprofit news organization focused on Wyoming people, places and policy.