By Jonathan Gallardo

Gillette News Record

Via- Wyoming News Exchange

GILLETTE — Officials from Campbell and Johnson counties say they need more help when it comes to collecting unpaid mineral production taxes.

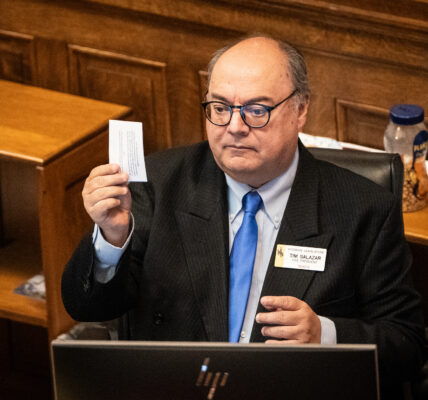

During a meeting Monday with the Select Committee on Coal/Mineral Bankruptcies, commissioners and attorneys for the counties asked state legislators to make changes to give counties more leverage when it comes to collecting what is owed them.

Jeffery Liesemer, an attorney who has represented Campbell County in bankruptcy court, recommended cleaning up language in state law to give counties more help to collect unpaid taxes. A county lien now is superior and paramount to all other liens, claims, mortgages or any other encumbrance of any kind, but it only encumbers the property of a delinquent taxpayer.

For example, Cloud Peak Energy Corp., which owns and operates two large coal mines in Campbell County, paid the $617,000 it owed in county property tax on May 9. The next day, it filed for Chapter 11 bankruptcy protection just hours before $8.3 million in ad valorem tax was due to be paid.

“Right off the bat, there’s a defensible argument the lien doesn’t even attach to the property” unless the taxpayer is delinquent, Liesemer said.

A company can file for bankruptcy before becoming delinquent on its taxes, he said. In that case, a county has no reason to file a lien notice if a company isn’t delinquent.

And when a company goes into bankruptcy, an automatic stay takes effect, which prevents the company’s creditors from collecting the debts owed to them.

Barry Crago, deputy county attorney for Johnson County, said the ongoing battle with Vanguard Natural Resources “illustrates that perfectly.”

For years, Vanguard had been paying its taxes in full and on time. Then in 2018, it decided it was going to try to get back some of the taxes that it had already paid. The oil and gas firm sued Campbell, Sublette, Park, Natrona, Johnson, Carbon and Sweetwater counties for $5.2 million in paid taxes.

Wyoming’s language when it comes to liens is long and complex, while the lien statutes in Texas and Montana are simple, short and straightforward, said Campbell County Administrative Director Carol Seeger said.

“Our attempts at adding verbiage (to the statute) has made it questionable about the superiority of our liens,” she said, adding that it is this question of superiority that has become an issue in recent years.

Of the money the county is working to collect, 73% goes to the state to be redistributed to school districts.

Campbell County School District Superintendent Alex Ayers said energy industry bankruptcies and unpaid taxes have affected school districts around the state. His district will have to take out a $10 million to $15 million loan next spring in order to pay for expenses. It hasn’t had to do that for several years, Ayers said.

It’s not a problem unique to Campbell County. In Johnson County, government officials are dealing with bankruptcies in the oil and gas industry, as well as companies that keep operating without paying their taxes, said Johnson County Commission Chairman Bill Novotny.

In 2015, Anadarko sold its assets in Johnson County. Carbon Creek and Powder River Midstream now operate those wells. Those two companies paid their 2015 taxes under protest. They have not paid their 2016, 2017 or 2018 taxes in full.

“If they declare bankruptcy tomorrow, none of those funds would be recoverable,” Novotny said, adding there isn’t much he or the county can do about it.

“They continue to operate in my county, using county roads and other services while not contributing to the tax base that sustains those services,” Novotny said.

Crago suggested another change to the statute’s language. For any lien related to mineral production starting Jan. 1, 2021, the county lien is perpetual against all people excluding the United States and the state of Wyoming and attaches and is perfected immediately upon production of the mineral subject to all prior existing liens.

The last part of that sentence, “subject to all prior existing liens,” needs to be changed, Crago said. With that language in there, counties “have no leverage.”

If another creditor already has a lien on a company’s property, there’s nothing left for counties to put a lien on.

“All the liens in the world don’t do us any good if there’s nothing to go get,” Crago said.

Liens are an “after-the-fact” solution, Crago said, adding that the Legislature needs to come up with something that will help counties before the fact.

“We have no leverage,” he said. “Literally zero.”