By Andrew Graham, WyoFile.com

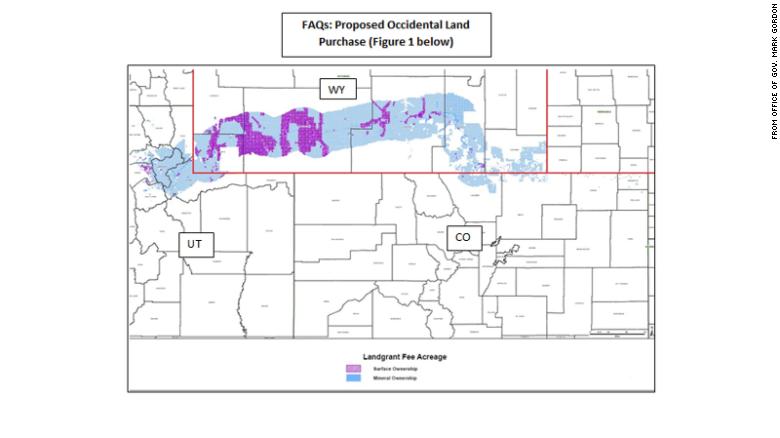

Gov. Mark Gordon’s administration is preparing a bid to Occidental Petroleum for 1 million acres of surface land and 4 million acres of mineral rights, and is using a process that won’t require legislative approval, according to executive branch officials.

State officials have opted to pursue the purchase — the cost of which has never been publicly disclosed but has been estimated at more than $1 billion — as an investment of funds already under control of the state treasurer’s office. Doing so eliminates the need for an appropriation from the Wyoming Legislature under state statute, officials said, provided the purchase is considered a “prudent investment.”

Occidental has asked for a bid by July 1, Patrick Fleming, the state’s chief investment officer, said.

The news follows months of quiet on the purchase of the vast swath of “checkerboard” land that parallels Interstate 80. Gordon announced in February that state officials were considering the purchase and it was a much-discussed topic during the 2020 legislative session that ended in March.

Since then, the state has been consumed by the COVID-19 pandemic and its catastrophic economic impacts. But officials and consultants from massive investment bank Barclays have been at work on the deal, and at some point the administration decided to make an offer without inviting further legislative debate.

“The [State Land and Investment Board] directed us to look at this like any other investment,” Fleming said. “The Legislature does not opine on our investments.”

The SLIB is made up of Wyoming’s five statewide elected officials — the governor, treasurer, auditor, superintendent of public instruction and secretary of state. The board will likely hold a special meeting before July 1 to vote on whether to proceed with the bid, Gordon’s spokesperson Michael Pearlman said. Such a meeting would include public comment, Pearlman said.

Labeling the purchase an investment means the land and minerals could be bought using money from the $7 billion Wyoming Permanent Mineral Trust Fund, the state’s largest sovereign wealth fund.

The governor has been consulting with leading lawmakers about the project, Gordon’s energy advisor Randall Luthi said.

The Investment Funds Committee, a group of experienced financial mavens who counsel the state on its financial holdings, has already considered the purchase and declared it a prudent investment, House Appropriations Committee Chairman Bob Nicholas (R-Cheyenne) told WyoFile on Tuesday. The vote was not unanimous, said Nicholas, who serves on the committee as a legislative liaison.

Fleming declined to comment on the committee’s deliberations, which he said were confidential given the discussion of a purchase where public knowledge of the state’s offer would hurt its negotiating position.

The nature of the deal necessitated secrecy for much of the deliberations, Pearlman said. “Our consideration was to make sure that we weren’t exposing sensitive information and so forth that can affect markets,” he said.

The state has competition on the purchase, the officials said.

Occidental Petroleum has weeded out other parties who professed interest and invited six potential buyers including the state to submit bids, Nicholas said. Nicholas and Fleming said they didn’t know who the competition is.

A deal could move quickly after Occidental accepts a bid, Fleming said. Such a purchase might require one to three months of due diligence by the parties, he said. Gordon’s energy advisor Luthi estimated that the assessment could take as long as six months. It was “yet to be determined” if the governor would take public input on the deal during that time, Luthi said.

“Investment decisions are typically made by our investment team and that’s how the governor looks at it,” Pearlman said.

The state’s interest in purchasing Occidental’s massive land and mineral holdings stretching from northeast Colorado along the I-80 corridor in southwest Wyoming and into Utah first became public following a surprise announcement at the start of the 2020 Legislative session. At that time, Gordon said he was seeking legislative involvement on the purchase, which lawmakers speculated could be paid for using the state’s “rainy day fund.” That savings account’s projected balance dropped below $1 billion following a devastating May report from the state’s revenue analysts.

That fund is likely off the table under the prudent investment rules, Fleming said, because it is required to maintain cash on hand and is unsuitable for a long-term investment.

At the session’s conclusion, however, Gordon vetoed a bill setting parameters and creating a more public process for the purchase, including holding public meetings in the counties containing the land.

Then in May, as a pandemic dominated headlines and upturned every aspect of Wyoming life, the state hired Barclays, a global financial-service behemoth, to evaluate Occidental’s land. The investment bank brought 23 bankers and numerous other analysts and researchers in to evaluate the deal, examining oil leases and mineral leases and surface land holdings to try and get a sense of its value, Fleming said.

Over those months, the governor began to increasingly consider the purchase as an investment of state funds that wouldn’t need legislative consideration, Luthi said.

The project has been all-consuming for Fleming and others, he said. “This is every day, and they’re long days,” he said.

Employees from the state treasurer’s office, consultants, the SLIB and Gordon’s informal advisory group, which is made up of oil, gas and mining industry leaders, have all been involved, he said. “It’s not like two people are just sitting there analyzing this,” Fleming said. “It’s a massive, massive amount of work.”

The behind-the-scenes work didn’t assuage the concerns of Bob LeResche, vice chair of the Powder River Basin Resource Council. The organization has raised a number of concerns about the purchase and the secrecy surrounding it.

“The lack of transparency is just absurd when you’re talking about so much public money at a time when the state’s going broke,” LeResche said. “It’s just beyond belief that they would not do this through the legislative route.”

PRBRC staff and members have been seeking information from Gordon’s administration for months, LeResche said Tuesday. They got answers during a meeting with Luthi this week.

The chair of the PRBRC board wrote to Gordon in April expressing concern about the purchase, and saying a pandemic that has devastated the state’s fiscal picture should be reason enough not to spend a large amount of the state’s capital on land and minerals. The group also raised concerns that the purchase represents another doubling down on energy when the state should be using its assets to diversify.

“A sovereign wealth fund is meant to allow spreading one’s eggs into new baskets, to hedge against a bust in the original source of earnings – in Wyoming’s case, the development of mineral resources,” the letter from PRBRC chair Marcia Westkott read.

LeResche had a career in investment banking and in Alaska’s state government, including as the state’s commissioner of natural resources and executive director of the Alaska Energy Authority. He called the purchase risky and as such an unwise use of public funds.

“Public funds should be invested at the lowest risk possible because there’s things like schools and public safety and roads involved,” he said. “It’s impacts to almost 600,000 people’s lives that they’re risking in this kind of stuff.”

LeResche was skeptical of operating under the state’s prudent investment rule, which he said was too loose. Officials “can prove any damn thing they want [is legal under] the prudent investment rule,” he said.

Those advancing the idea said they had conducted long-term analyses on the assets’ value. Occidental acquired the properties in August 2019 when it purchased Anadarko Petroleum. That company had acquired the land and minerals from the Union Pacific Railroad in 2000.

Gordon will not proceed with the purchase if he does not feel it is a fiscally-sound investment, his advisors said.

“The governor is very clear on this,” Pearlman said. “If the state goes forward it has got to be done on the basis that this is a good, prudent investment [and] would provide a rate of return that actually is going to help the finances of the state.”

Gordon also does not consider the purchase “doubling down” on fossil fuels, Pearlman said. Gordon believes the state could benefit from surface uses of the land like wind, solar and grazing leases, Pearlman said.

Oil prices crashed in early spring, as the result of a price war between Russia and Saudi Arabia. The pandemic’s slowing of economic demand deepened the industry’s woes.

Nicholas and Fleming both pushed back on suggestions that Occidental, which some industry watchers consider overburdened with debt, is teetering on the edge of bankruptcy. The company’s stock is improving after plummeting to $10 a share, Fleming said, and the company has assets that can cover its debt payments. Barclays’ analysts agree with that assessment, Nicholas said.

The pandemic’s impact on the oil industry, and Barclays’ appraisals, have brought the likely cost down from estimates floated during the legislative session, Nicholas said. At that point, the few lawmakers and officials who did know the potential purchase price were operating with estimates that had been provided by Occidental, he said.